tax loss harvesting wash sale

Wash Sales. When you sell you may be able to take advantage of tax-loss harvesting or selling investments that have dropped in value in order to offset taxable gains.

Tax Loss Harvesting Example Of Tax Loss Harvesting How Does It Work

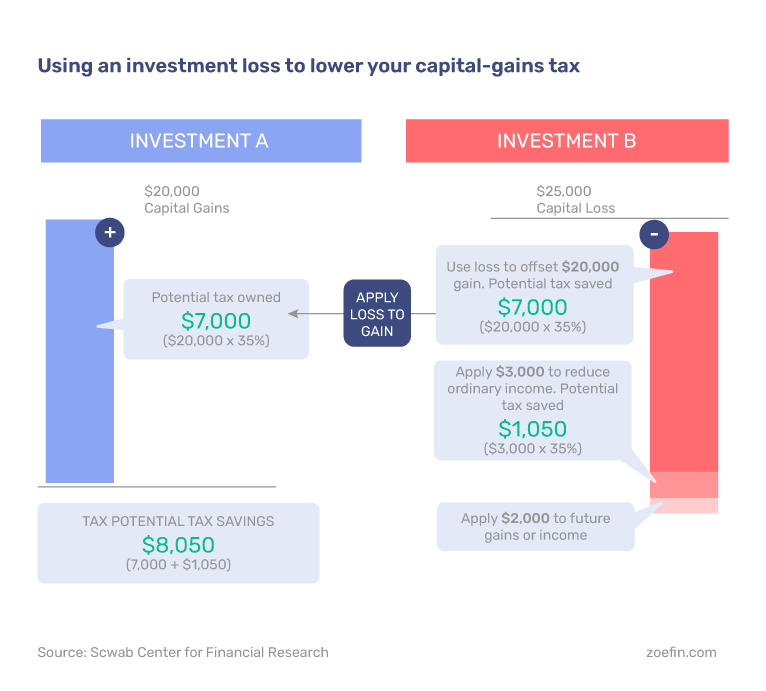

Tax-loss harvesting involves intentionally selling a security and taking a loss that is then used to offset a gain come tax time either within the same portfolio or elsewhere.

. In a down market you may consider tax-loss harvesting which can turn portfolio losses into tax breaks. There are safer ways to harvest losses on a crypto asset. Because your 800 loss is disallowed due to a wash sale the disallowed loss is then added to the price of your new shares to determine your cost basis for the new shares.

The Wash Sale Rule WSR is a measure introduced by the government and the Internal Revenue Service IRS to prevent investors from taking advantage of the tax code. If you rebuy a crypto asset after the 30 day period passes your actions no longer classify as wash sale trading. One of the most important rules surrounding tax-loss harvesting is the wash sale rule.

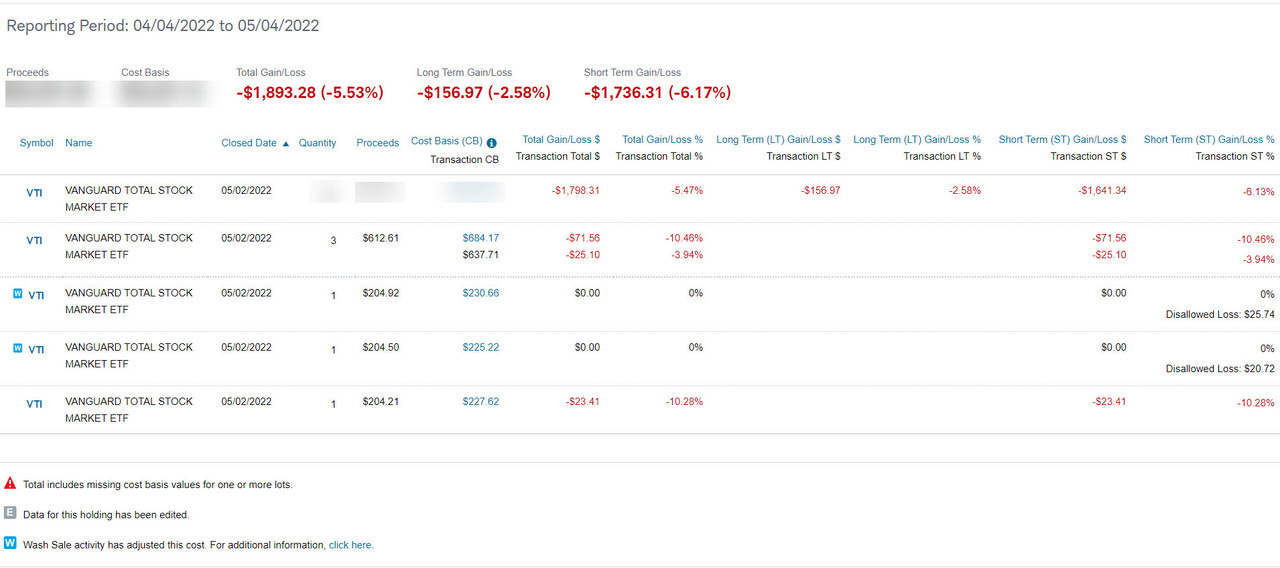

Tax Loss Harvesting vs. A wash sale is one of the key pitfalls to avoid when trying to take advantage of tax-loss harvesting to reduce your taxes and in falling markets such as in 2022 it can be valuable to make sure. Create a 1099-B for the sale which shows the details of the trade including the disallowed loss the cost basis of the tax lots sold whether the position.

An Internal Revenue Service IRS rule that prohibits a taxpayer from claiming a loss on the sale or trade of a security in a wash sale. Look for tax-loss harvesting opportunities. It would wash out 50 shares of the taxable loss.

To get around the wash-sale rule and the IRS definition of a substantially identical security Ann Guntli partner and portfolio manager at RMB. If the repurchase also closes at a loss and the deal continues within 30-days the loss gets carried to every new. So youre working with the wash sale 61-day rulea 61-day period.

The loss is moved forward and gets attached to the cost basis associated with repurchasing the security. Harvesting tax-loss benefits on an investment you dont intend to exit. But you need to familiarize yourself with the wash sale rule which blocks you from.

400 800. If you plan to take a loss and reinvest the proceeds be mindful of the wash-sale rule. The Wash Sale Rule.

If a repurchase takes place within 30 days the account has incurred a wash-sale. You cant use the losses to offset gains if you purchase the same or a substantially identical investment. When your broker determines that a wash sale occurred in your account they are required to.

However dont forget that the wash sale rule kicks in 30 days before the sale of the asset and runs 30 days after the sale. The wash-sale rule states that your tax write-off will be disallowed if you buy the same security a contract or option to buy the security or a substantially identical security within 30 days before or after the date you sold the loss-generating investment. Some contend that consistent tax-loss harvesting with the intent to repurchase the sold asset after the wash-sale waiting period will ultimately drive your overall cost basis lower and result in a.

How to use tax-loss harvesting to your advantage. A popular approach to doing this is known as tax-loss harvesting which is the process of selling underperforming assets with the goal of offsetting capital gains taxes. Calculate the loss amount of the trade and carry it forward into the cost basis of the replacement securities that you bought.

This rule prohibits you from selling an investment to book a capital loss to reduce your tax bill and immediately repurchasing it. A wash sale occurs when you sell. Safer crypto tax loss harvesting.

The rule defines a wash sale as one that. The wash sale rule prohibits an investor from taking a tax deduction if they sell an investment at a loss and repurchase the same investment or a substantially identical one within 30 days. To avoid a wash sale one approach is to trade the depreciated asset for a coin with which its price is closely correlated.

You can generally deduct up to 3000 or 1500 if married and filing separately of capital losses in excess of capital gains per year from your ordinary income. This is precisely what the wash-sale rule exists to prevent. Under the wash-sale rule intended to prevent gaming the system for tax benefits an investor has to wait at least 30 days to repurchase the same stock or.

Tax loss harvesting is an investing strategy that can turn a portion of your investment losses into tax offsets helping turn financial losses into wins.

What Is Tax Loss Harvesting Ticker Tape

Tax Loss Harvesting Flowchart Bogleheads Org

Tax Loss Harvesting How To Reap The Most Rewards Diligent Dollar

Top 5 Tax Loss Harvesting Tips Physician On Fire

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Definition Example How It Works

Year Round Tax Loss Harvesting Benefits Onebite

Reap The Benefits Of Tax Loss Harvesting

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Do S And Don Ts Of Tax Loss Harvesting Zoe

Top 5 Tax Loss Harvesting Tips Physician On Fire

Tax Loss Harvesting Real Example Of A Wash Sale And Irrelevant Wash Sale Bogleheads Org

Tax Loss Harvesting And Wash Sales Seeking Alpha

Tax Loss Harvesting Napkin Finance

Tax Loss Harvesting Napkin Finance

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management